Do more financial planning. Engage more clients. Grow your fee-for-service revenue.

Take back your time with automated invoicing, payment tracking, and streamlined compliance.

Implement AdvicePay, the industry-leading solution for efficient, compliant, and secure billing in your financial planning business.

billing & payment features you need:

Take the AdvicePay online tour!

Choose the plan that's right for you.

All the basics for a new firm or solopreneur.

- Up to 10 Client Accounts

- 1 Independent Advisor Account

- One-Time Invoicing

- Recurring Auto-Billing

- 0 Admin/Analyst Users

- AdvicePay Logo

Perfect for advisors and ensemble firms looking for multiple advisor accounts, advanced features, and customization options.

- All Essential Features

- UNLIMITED Client Accounts

- Multiple Advisor Accounts

- Advanced Payment Settings

- Customizable invoices, email and client portal

- Brand with custom logo

- eSignature

- Access to Integrations

An advanced platform for enterprise firms who require additional support, customized

features, and API integration.

- All Professional Features plus

- Home Office Portal

- Options for Invoice Approvals

- Customizable Advisor Permissions

- Oversight Of Plan Deliverables

- Sort Advisors Into Offices With Their Own Admin and Branding

- Custom Processes and Workflows

- API and Webhooks

- Dedicated Enterprise Relationship Manager

- Priority Support

- Custom Development Work

- Due Diligence

- Custom Training and Webinars

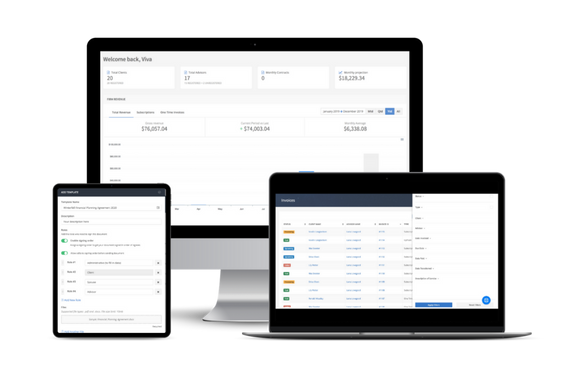

Watch a Demo

See AdvicePay in action and learn how you can handle billing and payment for all of your fee-for-service clients in one system.

Free Trial, anyone?

Need to try before you buy? Sign up for a free 14-day trial of AdvicePay. We’re so confident you won’t want to leave that we don’t ask for an upfront commitment.

The  story

story

We’re relatively new to fintech – but not to financial planning. Building AdvicePay is fueled by the passion and deep experience of our co-founders, Michael Kitces and Alan Moore. As leaders in the financial services industry, Michael and Alan are strong advocates for evolving the field of financial planning beyond assets under management to helping clients build wealth, from the ground up. The fee-for-service model of financial planning is now road-ready with AdvicePay. How did they do it? Learn more.

Made with love in Montana

We’re proud to be a local business with national impact, headquartered in the beautiful town of Bozeman, Montana. Learn more about our amazing team, in Montana and beyond.