Overview: How AdvicePay Works

Flexible Billing Options

Payment Processing

eSignature

RIA Compliance

Data Security

Fee Calculator

Personalized Support

AdvicePay is the only billing and payment solution designed for financial planners and their unique business needs. Explore the features created to serve you and your clients.

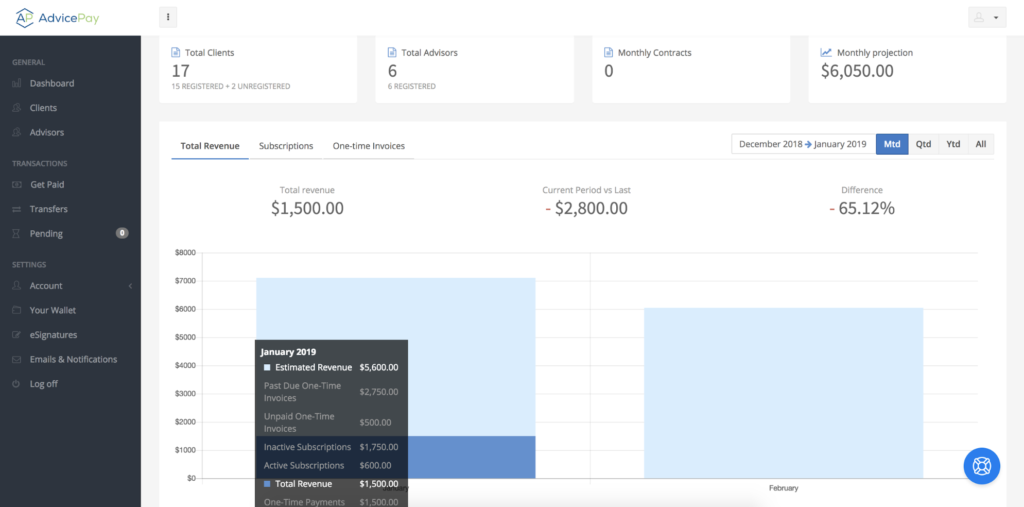

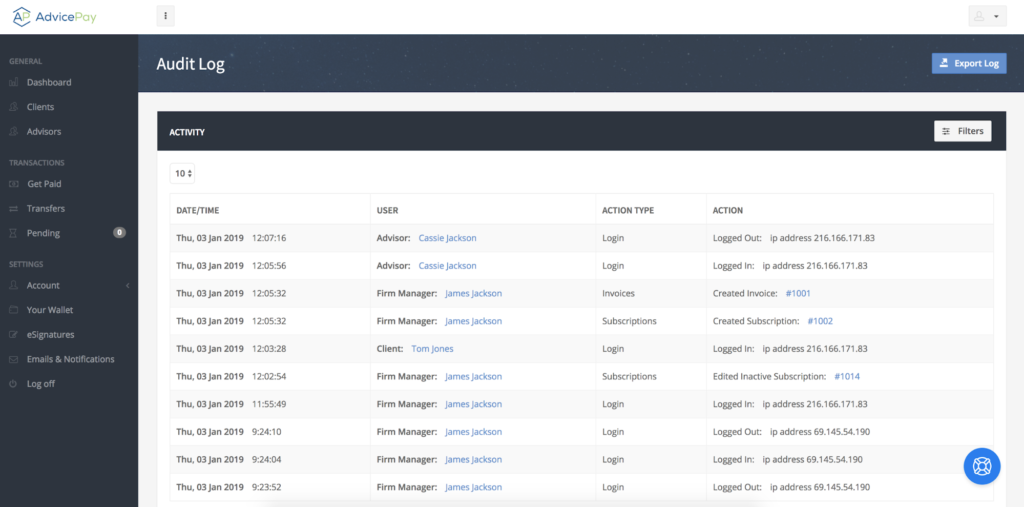

Your enterprise login will allow you to fully control the AdvicePay system leveraging administrative level access. All information will be available to the administrator. You can add advisors and clients, invoice clients, change the bank account that receives client funds, download transaction reports, and more.

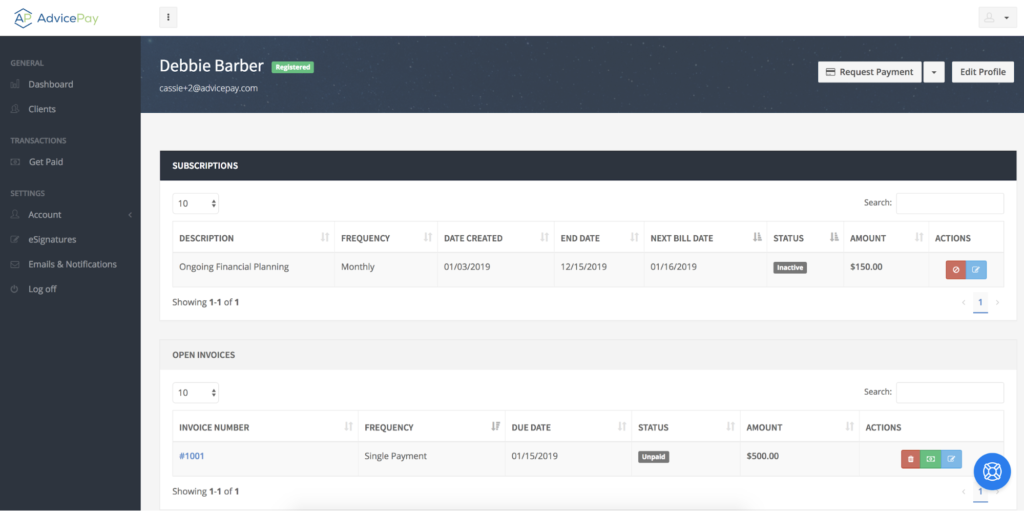

Administrators can add advisors to the AdvicePay system with login access. This allows the advisors to log into their own portal and manage client billing, while allowing you to maintain full oversight. This feature allows advisors to do all of the heavy lifting with manage client billing, contacting clients that haven’t yet paid, and more.

Does your firm prefer to manage all billing at the home office? Add advisors to the system to easily track which clients work with each advisor, however advisors won’t be granted a login into AdvicePay. This feature allows you to manage all of the billing for your firm in a centralized manner.

All account information is available at your fingertips. Easily download transaction reports to make reconciling your books and managing advisors payouts a cinch. Monitor active, inactive, and canceled subscriptions, along with overdue invoices.

NEW: eSignature for Enterprise

Upgrade your AdvicePay subscription to include eSignature. Manage client agreements and payment agreements along with billing and payment — all in the AdvicePay system. Learn more about eSignature.

While you are able to grant advisors login access to AdvicePay, their login comes with limitations. Advisors can only see clients assigned to them, segmenting client data between advisors. Advisors are also not being able to make change to the bank account on record that receives client funds.

AdvicePay was built from the ground up with compliance in mind. Our system helps advisory firms avoid custody by leveraging a custom workflow process designed specifically for financial advisors. Clients input their own payment information, avoiding the advisor having unnecessary access to that information. Clients must approve all invoice payments and subscriptions, which restricts an advisor’s ability to bill clients without their permission. You’ll never have to worry about your advisors accidentally triggering custody again.

Data security is our top priority at AdvicePay. Our payment processor Stripe is Level 1 Compliant, the highest level of compliance certification available to payment processors. All data at AdvicePay is encrypted and secured, to ensure your client information never falls into the wrong hands. We are happy to complete your firm’s due diligence questionnaire to provide your firm peace of mind.

Enterprise clients that commit to $2,500/month minimum fee receive a dedicated enterprise relationship manager at AdvicePay. Your relationship manager will be fully engaged in the success of your firm by:

Contat our sales team to discuss your needs and how AdvicePay can help. Email us at sales@advicepay.com.