ADVICEPAY ENTERPRISE

Fee-for-service financial planning on an enterprise scale

Optimize your processes, ensure organization-wide compliance, and accelerate growth with the platform trusted by firms at the forefront of financial planning.

.png?width=1200&height=1200&name=Website%20Image%20-%20AdvicePay%20Platform%20and%20Image%20-%20Enterprise%20(3).png)

Boost Productivity and Revenue

Quick Deployment

Start fast with off-the-shelf capabilities and configurable workflows

Effortless Compliance

Built-in controls ensure regulatory requirements and firm policies are met

Proven Performance

19 of the top 25 leading broker-dealers are scaling up with AdvicePay Enterprise

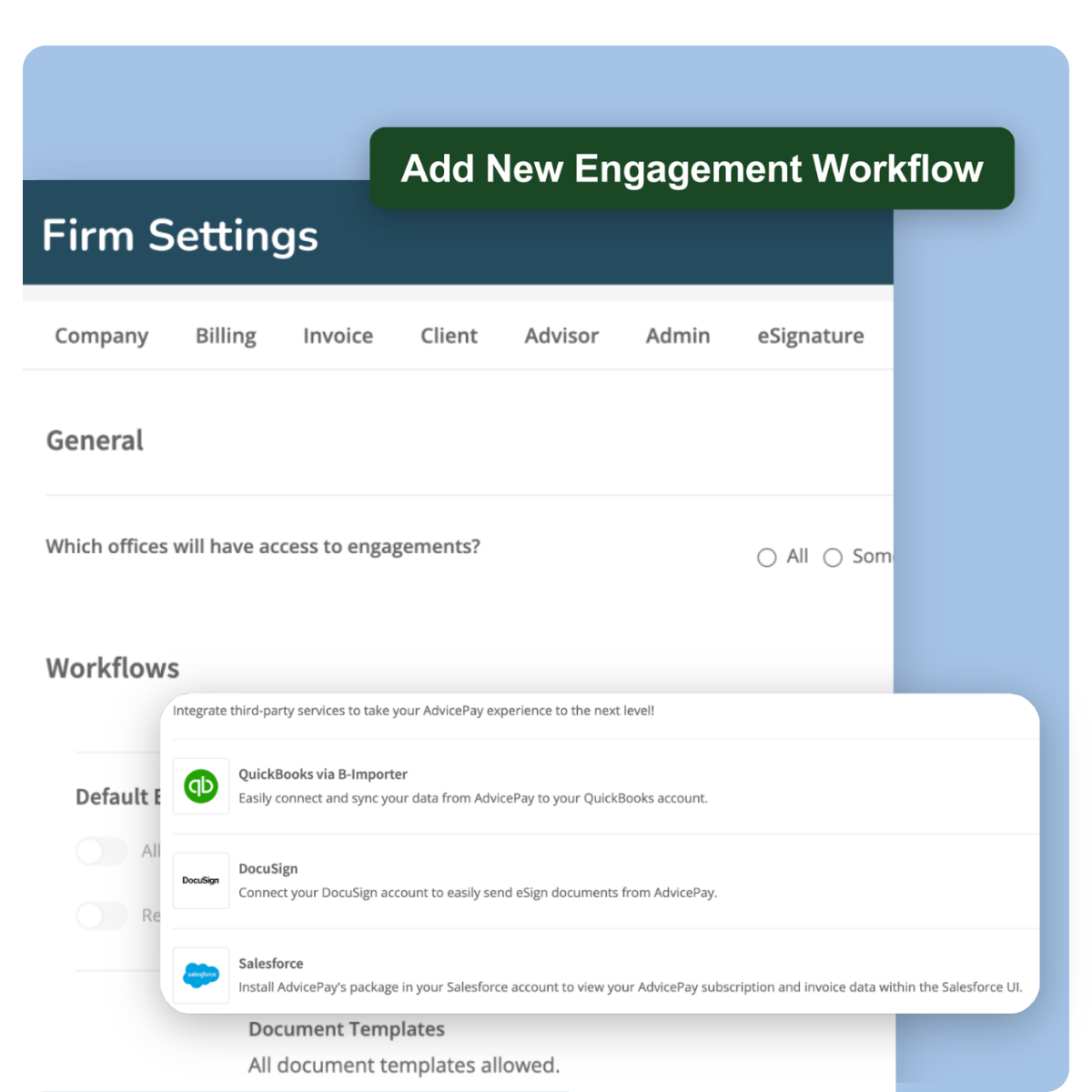

Get unmatched efficiency, without sacrificing control

Configure AdvicePay to work the way you do

Make sure oversight doesn’t become overwhelming

.png?width=1200&height=1200&name=Website%20Image%20-%20AdvicePay%20Platform%20Engagements%20-%20Enterprise%20(2).png)

100%

increase in fee-based planning revenue

3.2x

NNA growth for advisors charging planning fees

Trusted by leading broker-dealers and RIAs offering fee-based services

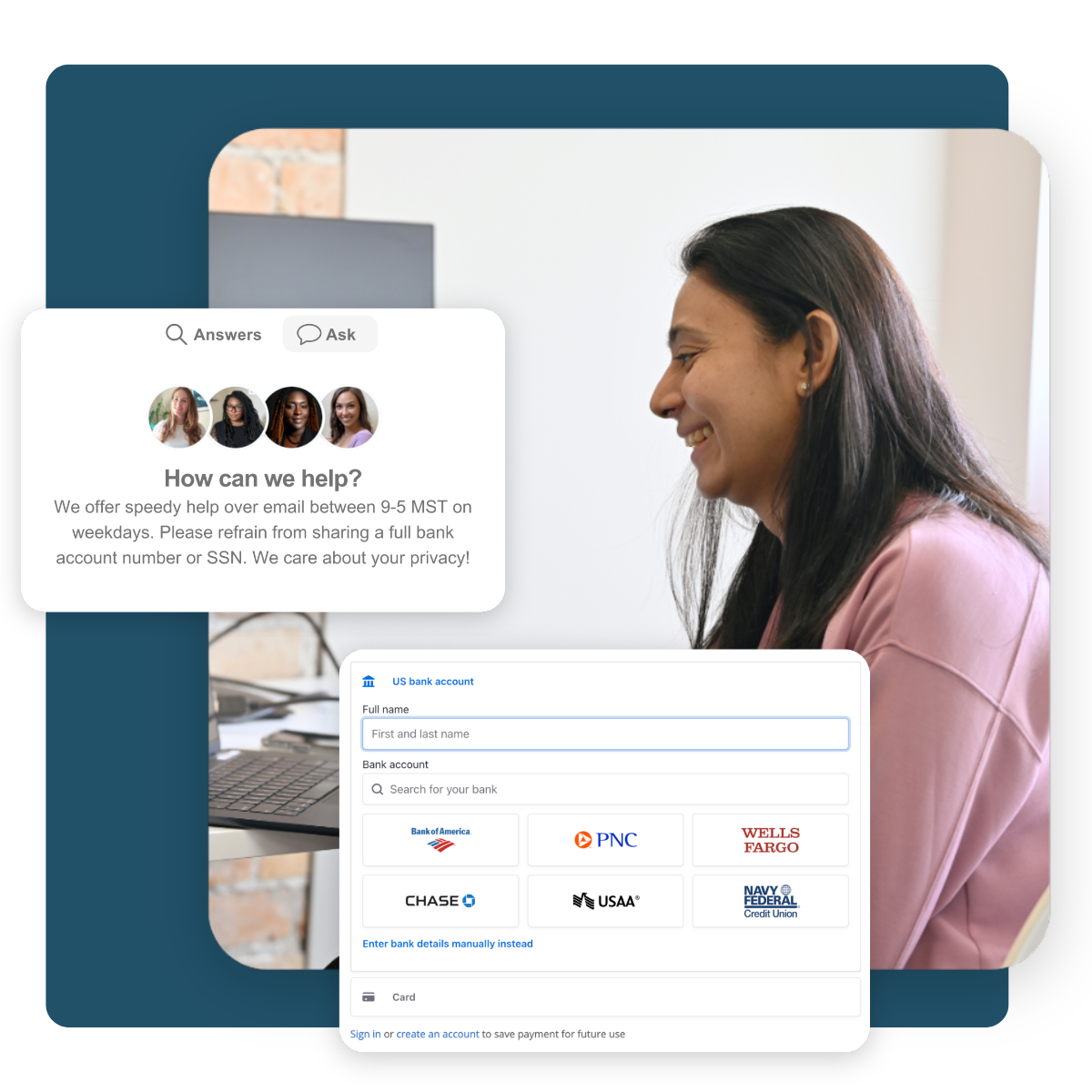

Get going, 4x faster

We know a successful onboarding experience is key to delivering successful outcomes. In as little as 90 days, our team will provide the training, enablement, and resources you need to get started with AdvicePay and integrate with your current systems.

From there, our ongoing partnership supports your continued momentum as you add more advisors to the platform, adopt best practices, and optimize workflows.

Enterprise-grade security for the most rigorous environments

We prioritize security so you can prioritize your business. AdvicePay guarantees compliance with the most demanding industry security standards, based on the standards defined by both ISO 27001 and NIST 800-53. In addition to routine internal assessments, we perform a SOC 2 Type II audit, PCI SAQ A, and third-party vulnerability assessment annually. Our platform has passed security reviews from some of the strictest financial services enterprises.

Bring more planning fees into your revenue mix

Explore these free resources designed to help your firm scale fee-for-service financial planning.

Build or Buy?

An exploration of the advantages of buying vs. creating and maintaining software solutions

Fee-for-Service Trend Report

Compilation of fee-for-service planning data and key findings from 2023

Data Security

How AdvicePay keeps your data secure