CONFIDENTLY GROW YOUR FEE-FOR-SERVICE REVENUE

Compliance and oversight tools

AdvicePay is built to address advisory firms' unique compliance issues when incorporating a fee-for-service model into their practice.

Ditch the paper checks and spreadsheets. Centralize financial plan oversight in one platform that can create and enforce compliant billing workflows. Avoid the risk of regulatory fines, and easily provide validation to auditors when needed.

Ensure quality and compliance with tools designed to scale with your fee-for-service program

Review and report on every plan

Compliance teams can design templates and workflows to meet regulatory requirements with automatic due dates, reminders, and approval triggers to ensure advisors adhere to your firm’s policies every step of the way. And with all fee-for-service agreements, invoices, subscriptions, and deliverables in one system, AdvicePay centralizes oversight to make it quick and easy for compliance managers to review every plan, not just a spot check of a small sample.

When an audit is requested, AdvicePay has your organization covered. Simply download records like invoices, activity logs, and email logs to report on all actions taken by advisors, back office staff, and clients.

Synchronize contracts and invoices

Firms can manage client agreements and prevent data errors by activating AdvicePay’s complimentary eSignature service or using one of our other eSignature integrations. Compliance and legal teams can assign specific contract templates to specific types of client engagements and include having the client sign them as a required step in the billing process. Plus your team will feel confident knowing that invoice amounts and other key information are automatically pulled into the contract, so there’s never a data mismatch that results in client refunds or compliance headaches.

Avoid triggering custody

A 2013 SEC Risk Alert noted that having online access to client accounts can trigger custody, if the online access includes the ability to withdraw funds or transfer funds to another account. While it’s not illegal for financial advisors to have custody, those who do are subject to substantial, additional compliance oversight requirements, including the obligation to arrange for an annual “surprise” audit — costing advisors time and money, upwards of $10,000 or more.

AdvicePay guards against custody by ensuring that clients always enter their own payment information and that advisors cannot view a client’s bank account or credit card information. AdvicePay also documents client approval prior to billing, payment, and any billing or payment changes (like a fee increase). All these records are downloadable, so you’re prepared in the event of an audit.

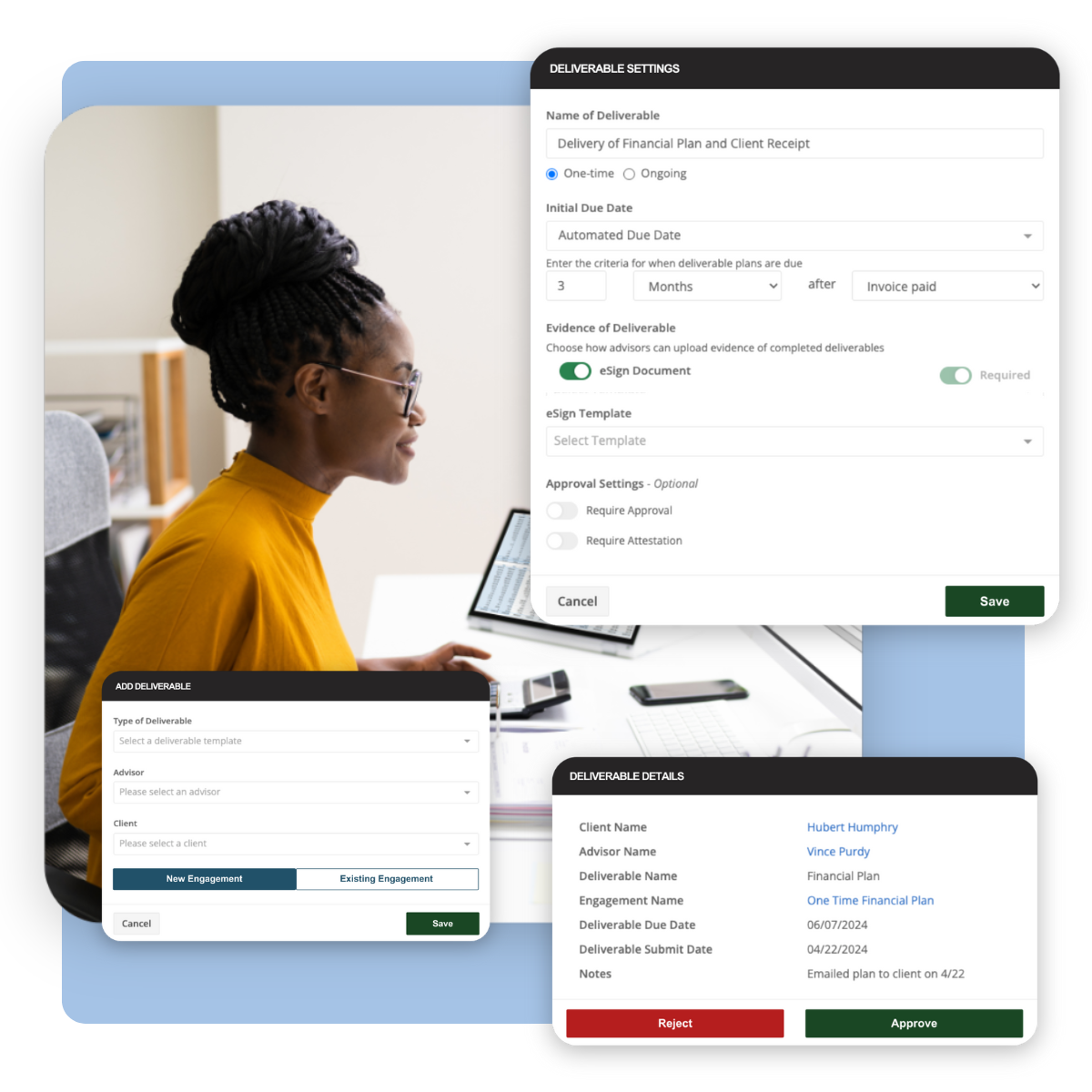

Automatically request and track deliverables

Include one-time or recurring deliverables as a required step in your fee-for-service workflow to provide validation that plans were delivered for the fees charged to the client. Advisors can upload documents or screenshots along with a digital attestation to verify that the firm’s policies and procedures were followed. Designated reviewers can approve or reject deliverables and effortlessly track all open, past-due, and completed deliverables.

Easily adapt to regulatory changes

Regulators frequently issue rulings and preferences that change the way financial advisors do business. Because AdvicePay is dedicated to financial planning, we respond quickly to regulatory changes from the SEC, FINRA, or state regulatory bodies.

A few of the changes we’ve made to adhere to new regulatory requirements and preferences include allowing clients to cancel subscription payments through their portal, without having to contact their advisor (Utah), including date ranges on subscription invoices (Washington), and the ability to download invoices for compliance records (multiple states).

Keep information secure

At AdvicePay, we take data security very seriously. Our platform has robust security measures to safeguard sensitive financial information. We only use encrypted communication and – unlike other payment platforms – client payment information is never stored in our databases.

We also perform an annual SOC 2 Type II audit – this Attestation of Compliance is widely known as the industry benchmark for SaaS businesses and the most stringent examination of an organization’s security controls, policies, and procedures.

Frequently Asked Questions

Unlike other billing and payment platforms, AdvicePay is built to handle the unique compliance requirements for financial services. Clients always retain control over their subscriptions and must approve all payments and changes to their subscriptions. We also support the work of Compliance teams by enforcing workflows for their representatives designed to meet regulatory guidelines.

AdvicePay documents every action so that you have the supporting evidence you need to prove to regulators that your firm is compliant and that clients received the appropriate financial plans for the fees you billed them.

AdvicePay Blog

Ensuring Ironclad Security: A Closer Look at How AdvicePay Keeps Your Data Secure

Evaluating Your Billing & Payment Solution: Key Questions to Ask As a Financial Advisor