AdvicePay Enterprise

Enable your advisors to bring more fee-for-service financial planning into your organization's revenue mix with scalable and efficient workflows, up-to-date compliance tools & management, and intuitive portals for optimal home office, advisor, and client experiences.

Support Fee-For-Service Financial Planning Revenue Models For Your Advisors To Reach Next Generation Clients

Established financial services firms are facing significant demographic challenges with an aging client base but have struggled to serve smaller AUM clients profitably. A move towards innovative new financial planning fee-for-service business models allows forward-thinking enterprises to extend their reach beyond traditional AUM clients and sustainably and profitably serve younger clientele with recurring financial planning fees.

Oversee Fee-For-Service Financial Planning as an Enterprise...Profitably

Operationalizing and scaling a large volume of recurring financial planning fees is impossible when every client writes a check. And it can be even more challenging to oversee advisors charging such fees to ensure they’re actually providing the appropriate financial planning deliverables. Existing commission and AUM revenue management systems simply aren’t capable of handling the significant shifts, from fee billing to collections, compliance oversight of deliverables to payment processing. That's where AdvicePay comes in:

Ready to see how it works?

Have a question? Talk with an expert!

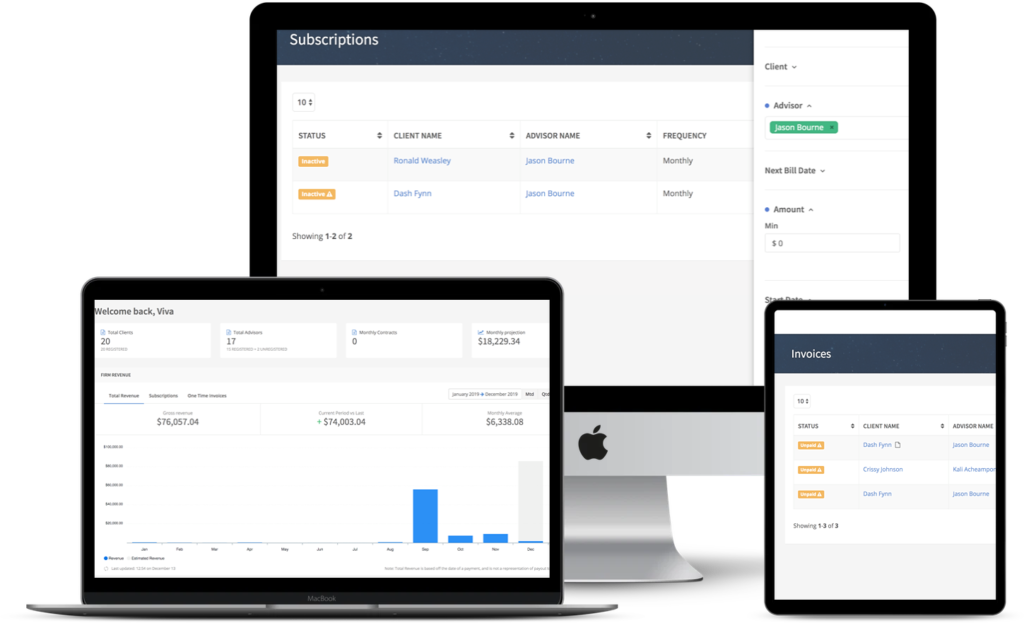

Centralize Payments & Financial Plan Oversight

Manage Your Firm

Whether setting firm-wide financial planning fees, customizing invoices for individual engagements, accounting for what's been billed and paid, or managing a team of advisors offering fee-for-service financial planning, AdvicePay Enterprise is ready to provide your organization with intuitive, customizable support.

Maintain full visibility and access to billing, while retaining control through flexible internal permissions and approvals.

Managing compliance is a chief concern for every firm. That is why AdvicePay was built from the ground up with compliance in mind. AdvicePay is the only billing and payment solution designed exclusively to serve the financial advisory industry. That means we’re built to comply with the myriad of industry regulations, and when state, SEC, or FINRA regulations change, our platform adjusts. Ensuring that processes and procedures remain current with ever-changing state and Federal rulings and regulator preferences is an important job.

We will show you how to do fee-for-service compliantly and give you all the compliance tools necessary to verify financial planning deliverables. With AdvicePay Deliverables, you can scalably review deliverables in real-time, and throw out that spreadsheet for good! Avoid the risk of regulatory fines, and provide validation to regulators that the plan was delivered for the fees that were charged.

AdvicePay supports the work of Compliance Officers and Compliance Managers by enforcing workflows for their Representatives designed to meet regulatory guidelines and providing tools for oversight. You will feel confident that things are not falling through the cracks -- be able to easily review every plan, not just a sampling of them.

AdvicePay equips organizations to report on all activities when an audit is requested. Clients input their own payment information, avoiding the representative or firm having custody-triggering access. In addition, clients must approve all invoice payments and subscriptions, which restricts an advisor's ability to bill clients without their permission. You'll never have to worry about your representatives handling paper checks again!

AdvicePay maintains a proactive approach to protecting the account and financial information of firms, advisors, and clients. From the cloud-based services we utilize, to our testing and maintenance approach, we're committed to providing a platform that leverages state-of-the-art security measures.

AdvicePay has completed the SOC II Type 2 examination and audit. A SOC 2 audit provides an independent, third-party validation that a service organization’s information security practices meet industry standards stipulated by the AICPA. This Attestation of Compliance is widely known as the industry benchmark for SaaS businesses and the most stringent examinations of an organization's security controls, policies, and procedures, and we are proud to exceed customer expectations when it comes to protecting their data.

Our payment processor Stripe is PCI DSS Level 1 Compliant, the highest level of compliance certification available to payment processors. All data at AdvicePay is encrypted and secured, to ensure your client information never falls into the wrong hands. We are happy to complete your firm's due diligence to provide your firm peace of mind.

We never store any payment information on the AdvicePay database. So, no one has to worry about their information being compromised.

Automate the Entire Lifecycle of Fee-for-Service Financial Planning — All in One Comprehensive System!

The AdvicePay platform allows your home office professionals to oversee the entire engagement process of your advisors with their clients, from agreement to payment, to evidence of delivery of service. Track all fee-for-service agreements, deliverables and payments in one place with AdvicePay.

All of the core functions available within the AdvicePay platform — invoicing, document eSignatures, approvals, and deliverables — can be bundled together in fully customizable and automated sequences that make providing and overseeing fee-for-service financial planning both fast and compliant.

Our team of experienced technicians and relationship managers will work with you to customize your firm’s workflows and automate approval processes to increase efficiencies and manage oversight of this profitable business model.

AdvicePay is a compliance department’s dream solution. The platform ensures agreements are signed, invoices match agreements, invoices get paid, and all documents are archived.

This customizable platform helps you avoid regulatory fines and can efficiently provide validation to regulators that the service was delivered for the fees that were charged. Support fee-for-service and avoid fee-for-NO-service!

Want to learn more about designing and deploying your own custom processes & workflows in AdvicePay Enterprise?

Diversify Your Financial Planning Revenue

(And Client) Mix

Integrating innovative new fee-for-service models to diversify your revenue mix and breadth of clients is a key business development project for more and more financial services enterprises. Expand your financial planning revenue and the breadth of clients you serve with AdvicePay Enterprise.

Embed AdvicePay In Your Technology

AdvicePay offers enterprises a secure API so that you can achieve integration of your system and AdvicePay to create a seamless experience for home-office, advisors, and clients. Your developers can use our APIs to automatically create users in AdvicePay as they are added in your systems, as well as to dynamically pull invoices, agreements, and deliverables from AdvicePay so they can be saved within your chosen document storage solution.

Seamlessly Integrate AdvicePay with the Tools You Already Use

The AdvicePay Experience

Home Office Experience

Home Office Portal

Dedicated Relationship Manager*

Custom Training & Webinars*

Multiple Advisor Management

Invoice Approvals (optional)

Customizable workflows to automate the entire lifecycle of fee-for-service financial planning engagement

*Contingent on enterprise plus contract

Advisor Experience

Customizable Billing Options

Advisor Portal

Personalized Customer Support

Access to Industry Integrations

Online Check Deposit

Advisor Knowledge Base

Compliant Workflows to Avoid Custody

Client Experience

Customizable Client Portal

Client Communication Emails Sent from AdvicePay

Personalized Emails and Invoices

Customer Support Team

Client Knowledge Base

Onboard With AdvicePay in 90 Days or Less

We Will Support You Every Step of The Way

Learn how other firms are growing with AdvicePay.

Learn how other firms have utilized AdvicePay to add flexibility to their fee structure and expand their client pool.

"Over the course of the last year and a half since working with AdvicePay, we have really seen a significant change in our financial planning revenues at the firm. We are projecting about a 40% increase in direct financial planning revenue largely due to the streamlined billing process and flexible payment options that AdvicePay provides."

Jamie Kulik, CFP®, Vice President, Financial Planning, LPL Financial

You're In Good Company

Are you ready to grow with AdvicePay?

Designed to provide firms with the management structure, controlled visibility and settings needed to oversee multiple advisors and their clients, AdvicePay Enterprise makes it possible.